The general insurance industry is both dynamic and competitive, offering diverse opportunities for professionals with the right skills and qualifications. Whether you’re aiming for a role in underwriting, pricing, risk assessment, capital & reserving actuaries; your CV is your first chance to impress potential employers.

In this guide, we’ll walk you through crafting a tailored CV that highlights your strengths, aligns with industry expectations, and gets you noticed by hiring managers. We’ll also include a sample CV to help you visualize a professional layout.

Understanding the Importance of a Tailored CV

A tailored CV goes beyond listing your qualifications and work history. It specifically aligns your experiences, skills, and achievements with the requirements of the job you’re applying for.

In general insurance, tailoring your CV can mean emphasizing your expertise in risk analysis for underwriting roles or showcasing your customer service achievements for claims management positions.

Here are some benefits of a Tailored CV:

- Increases Relevance: Shows you understand the unique demands of the role and the company.

- Demonstrates Effort: Customization signals genuine interest and dedication.

- Improves ATS Compatibility: By using job-specific keywords, your CV is more likely to pass Applicant Tracking Systems.

- Demonstrates Industry Knowledge: It reflects your understanding of key industry trends, terminologies, and role expectations.

Key Skills and Qualifications to Highlight in Your CV

To capture the attention of hiring managers in the general insurance sector, focus on these critical skills and qualifications:

- Top Skills for General Insurance Roles

Risk Assessment: Showcase your ability to evaluate and mitigate potential risks, a core function in insurance.

Analytical Thinking: Highlight experience in analyzing data, trends, and reports to make informed decisions.

Customer Service Excellence: Employers value candidates who can build strong client relationships and ensure customer satisfaction.

Regulatory Compliance: Emphasize knowledge of industry regulations and your commitment to adhering to legal standards.

Communication: Demonstrate strong verbal and written communication skills for negotiating, reporting, and client interactions.

- Key Qualifications and Certifications

Highlighting your educational background and certifications enhances your CV:

- Degrees: Bachelor’s in Insurance, Finance, Business, or Economics.

- Certifications: Chartered Insurance Institute (CII), ACII, DipCII, or relevant diplomas.

- Training: Courses in risk management, financial analysis, or customer service.

- Valuable Experience

Focus on accomplishments that align with general insurance roles, such as:

- Managing complex claims cases.

- Enhancing customer retention rates.

- Developing innovative risk assessment models.

Structuring Your CV for Maximum Impact

A well-organised CV ensures hiring managers can quickly find the information they need. Use this structure:

1. Contact Information

Place your full name, phone number, email address, and LinkedIn profile at the top.

2. Professional Summary

A concise, tailored summary that highlights your expertise and career goals. For example:

“Experienced General Insurance Specialist with 7+ years in claims management and risk assessment. Proven ability to reduce claim resolution times by 25% while maintaining regulatory compliance. Seeking to leverage skills in underwriting and analytics to contribute to XYZ Insurance.”

3. Work Experience

- List roles in reverse chronological order.

- Include job title, company name, dates of employment, and key achievements.

- Use bullet points to quantify results where possible (e.g. “Reduced underwriting errors by 15% through process improvement“).

4. Education and Certifications

Include relevant degrees and certifications. For instance:

- Chartered Insurance Institute (CII) – ACII Qualification (2021)

- Bachelor of Science in Insurance and Risk Management, XYZ University (2015)

5. Key Skills

List technical and soft skills in a separate section e.g. Risk Analysis, Policy Review, Team Leadership

6. Additional Information

This section can include languages, professional memberships, or volunteer work related to insurance.

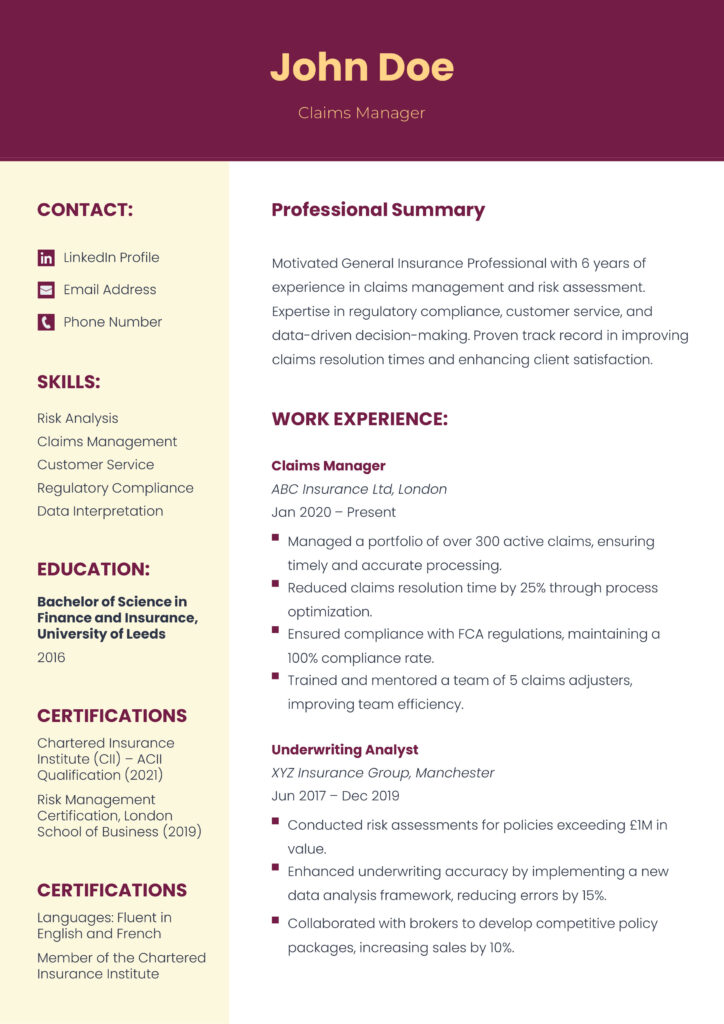

See sample below:

Common Mistakes to Avoid in CV Writing for Insurance Roles

1. Using a Generic CV: Recruiters notice when candidates fail to customize their applications. Tailor your CV to each role by including relevant keywords and highlighting role-specific experiences.

2. Overloading with Jargon: Avoid excessive use of industry buzzwords. Keep your language clear and professional to ensure accessibility.

3. Neglecting to Quantify Achievements: Numbers make your CV more impactful. Instead of writing “Handled claims,” say, “Processed 200+ claims monthly with 98% accuracy.”

4. Formatting Errors: Poor formatting can make your CV hard to read. Stick to clean, professional designs with consistent font sizes and bullet points.

5. Omitting Contact Information: Always double-check that your contact details, including email and phone number, are correct and prominently displayed.

Tips for Optimizing Your CV for Applicant Tracking Systems (ATS)

Many general insurance companies use ATS to filter applications. Here’s how to ensure your CV gets through:

Incorporate Relevant Keywords: Analyze the job description and mirror keywords and phrases in your CV.

Use Standard Headings: Stick to conventional section titles like “Work Experience” and “Education.”

Keep the Design Simple: Avoid graphics, columns, or unconventional fonts that may confuse ATS software.

Save in the Right Format: Submit your CV in Word or PDF formats, as per the application requirements.

Bonus Tips: Crafting a Standout CV

- Proofread Thoroughly: Typos and grammatical errors can ruin a great CV.

- Keep It Concise: Aim for a two-page CV unless you have extensive experience.

- Use Action Verbs: Start bullet points with words like “Led,” “Managed,” or “Implemented.”

- Seek Feedback: Have a trusted colleague or mentor review your CV.

Conclusion: Build Your Career with Confidence

A strong, tailored CV can make all the difference when applying for general insurance roles. By focusing on relevant skills, quantifying achievements, and maintaining a clean structure, you can position yourself as a top candidate.

Looking to advance your career in general insurance? Connect with Hewitt Stone to explore opportunities with leading employers.