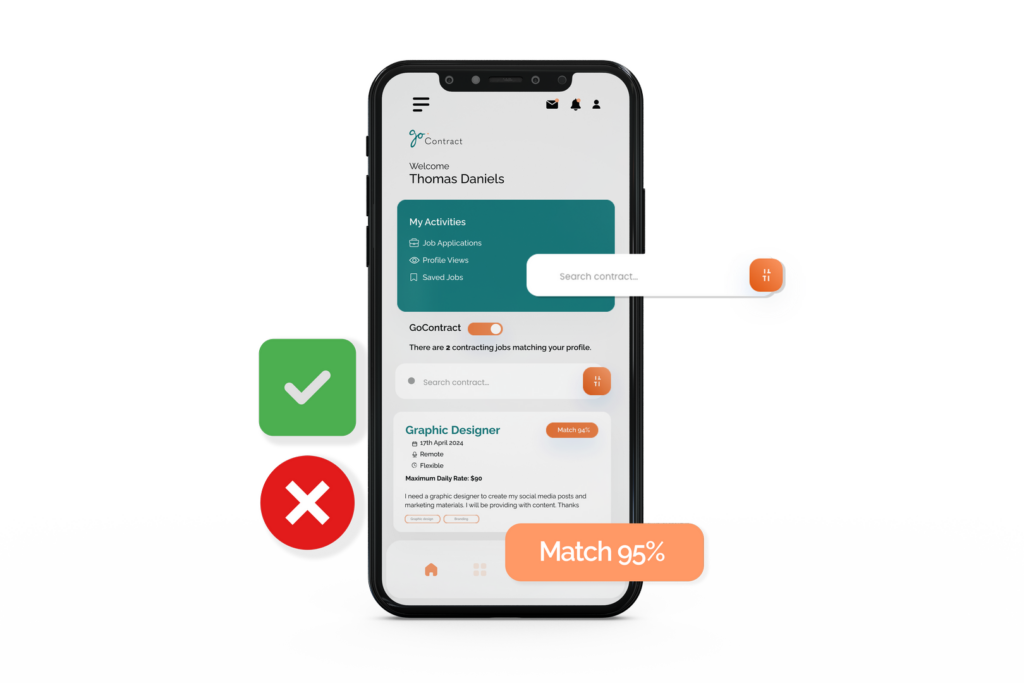

Post a contracting job and connect with top-rated contractors with the skills and experience you want. Simplify your search, connect instantly, and engage with top-tier talent ready to propel your projects forward. Experience seamless, cost-effective collaborations that drive success.

Start your journey with GoContract.

"Tobi has been significant in assisting our business by increasing visibility, and she has also assisted us in comprehending ad strategies. Since she joined our team, we have been able to save 30% of the budget designated for digital marketing."

Madison Wells

"I made the decision to give this a try. The individual I hired is extremely creative as well as effective, and I'm pleased with the level of quality they provide."

Attain Leadership

"I took the opportunity to work with Paul, I don't regret it because has assisted me in growing my social media accounts, and we are gradually seeing results! It looks good on my brand!”

Copyright © 2024 GoContract

Victor BoluWeb Automation